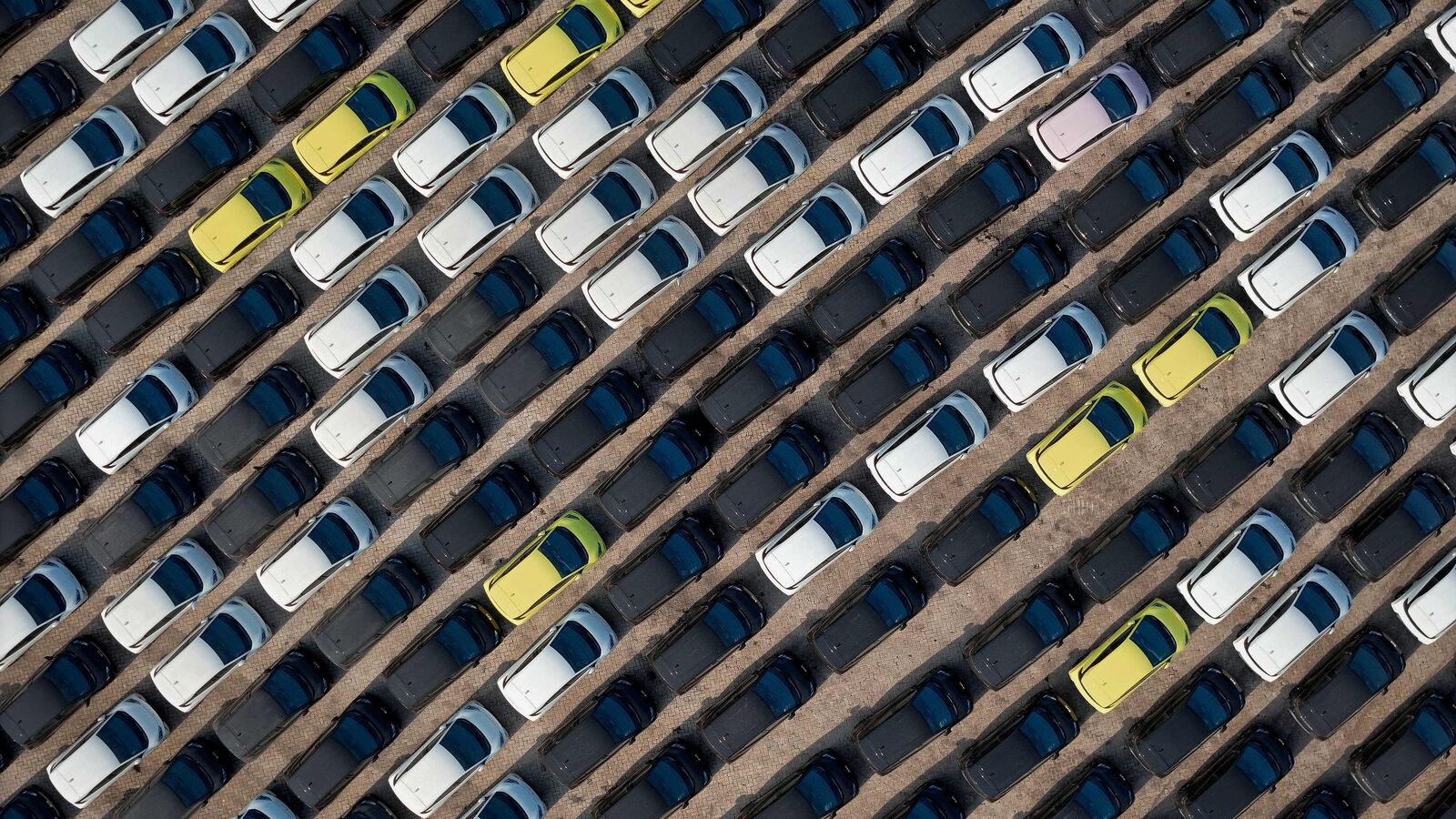

US new car sales fell to 3.9 million cars and trucks in the three-month period ended Monday, a 2.3% drop from a year earlier and off 4.7% from the previous quarter, according to automotive research firm Edmunds.com Inc.

High prices, hope for lower financing costs and even a bit of anxiety about November’s election between Vice President Kamala Harris and former President Donald Trump kept buyers at home. Above all, they’re waiting for better deals.

“In time, interest rates will help in terms of affordability,” said Rory Harvey, General Motors Co.’s president of global markets. “There is still pent-up demand that could be released depending on how things play out.”

GM’s sales fell 2.2% to 659,601 vehicles in the latest quarter on lower fleet buyer volumes, but it grew retail deliveries by 5% and said it maintained high prices that boosted profits in the first half of the year. Toyota Motor Corp., Honda Motor Co. and Hyundai Motor Co. Notched single-digit quarterly gains.

Automakers said September numbers were affected by a calendar quirk with the bulk of the Labor Day weekend holiday sales coming in the previous month. All major Asian automaker brands saw US sales drop last month.

Stellantis NV plans to report US sales results later on Tuesday. Ford Motor Co. and Tesla Inc. are expected to release their latest numbers on Wednesday.

In the last quarter of the year, the Federal Reserve’s half-percentage point reduction in benchmark rates on Sept. 18 — and possible additional half-point cut by year’s end — is expected to start trickling down into the form of lower car loan rates, which currently average 7.1% on new cars and 11.3% on used cars. That will likely prompt Americans to buy 15.7 million cars and trucks this year, up 1.3% from last year’s 15.5 million, research firm Cox Automotive Inc. has projected.

“Consumers don’t yet feel good about the future and confident that now is a good time to spend on big-ticket items,” Jonathan Smoke, Cox’s chief economist, said on a Sept. 25 call with reporters. “But that’s within reach. for the first time in a long time.”

GM maintains pricing

GM saw lower sales of its best-selling Silverado full-size pickup and Chevrolet Equinox compact SUV in the third quarter. But the first nine months of the year have been the automaker’s best overall since 2016.

While other automakers are offering more rebates to move inventory and offset higher interest rates, GM said its average transaction price of more than $49,000 was flat compared with the second quarter and its incentives spending was 2.6 points lower than the industry average.

The Detroit-based company sold more than 32,000 fully electric vehicles in the most recent quarter, led by the sub-$40,000 battery-powered version of its Chevy Equinox model.

Even so, one-third of car buyers said they are holding off on a new vehicle purchase until after the polls close on Nov. 5, based on the results of an August consumer survey by Edmunds. Republican presidential candidate Trump has vowed to scale back government support for EVs, while Democratic candidate Harris is expected to continue policies supporting EV adoption.

Toyota’s Hybrid Halo

Toyota sales fell more than 20% to 162,595 vehicles last month, led by drops in deliveries of its Corolla sedan and Highlander midsize SUV. Hybrids and other electrified models remained a strength, however, accounting for nearly half of its total sales volume and growing 22% from a year ago.

Jack Hollis, Toyota’s head of US sales operations, said the Japanese company’s production can’t keep up with hybrid demand. “Across Toyota and Lexus’ lineup, we have less than a five-day ground stock of every hybrid model” except for the Tundra pickup, he said in an interview.

Still, the Tundra has just a 20-day supply, which is still better than JD Power’s industry average estimate of 48 days in a dealer’s possession before sale.

For the full quarter, Toyota deliveries declined 8% to 542,872 vehicles, but it’s on track for the highest annual sales total since 2019. Hollis said Toyota may exceed the 2.38 million cars and trucks it sold that year, but that depends on the impact of events like the port strike, Hurricane Helene and the upcoming US election.

The labor action has already begun to affect operations at ports along the US East Coast and Gulf Coast. Dockworkers walked off the job this week at 36 ports — a major threat to the economy that JPMorgan Chase & Co. estimates could cost $3.8 billion to $4.5 billion a day.

New York Governor Kathy Hochul on Monday warned of significant disruptions for consumers, particularly car shoppers, with the strike leading to an immediate halt in auto shipments.

“If you’re expecting to be able to get a new car this week, it may be something you want to check with your dealer,” Hochul said. “It may not be arriving, for example, in the next few weeks.”

Hyundai’s sales slipped 9% in September to 62,491 vehicles on lower deliveries of its Santa Fe and best-selling Tucson SUVs. Demand for hybrid models grew 36% last month, it said, especially for gas-electric versions of those two models. For the third quarter, Hyundai said its US sales rose 5% to a record 210,971 vehicles.

“We see a huge shift right now to hybrids and we’ve been able to adjust accordingly,” Randy Parker, CEO of Hyundai Motor America, said on a call with reporters.

Sister brand Kia Corp. saw a 12% decline in September sales to 58,913, pulled down by lower deliveries of its Forte and Niro compacts. Japan’s Nissan Motor Co. said its US sales drifted 2.2% lower in the third quarter to 212,068 vehicles. Honda saw an 8.6% decrease in sales last month to 105,527 vehicles, but an 8% rise for the whole quarter to 366,214 vehicles.

Sticky sticker prices

At an average selling price of $47,870, up almost 20% since early 2020, Cox said many consumers still find new cars too pricey.

That’s despite growing showroom inventory and a softening of manufacturer’s suggested retail prices, with average Monroney stickers down 1.7% from a year ago. Monthly payments on car loans still average $767, up 17% from four years ago, according to Cox.

“Hyperinflation has made these cars really, really expensive,” Rhett Ricart, a Columbus, Ohio, auto dealer of Ford, GM, Hyundai and other auto brands, said in an interview. “And by increasing the technology content and the safety content on These vehicles, we packed on a lot of expenses.”

The closely watched annual sales rate fell to 15.6 million cars in the quarter ended Sept. 30, Cox estimated, down slightly from the year earlier and well off the pre-pandemic pace of 17 million vehicles sold a year.

“New vehicle sales remain stuck in neutral,” said Chris Hopson, principal analyst at researcher S&P Global Mobility. “Consumers in the market continue to be pressured by high interest rates and slow-to-recede vehicle prices, which are translating into high monthly. payments.”

For the month of September, however, vehicle sales rose slightly to an annualized rate of 15.88 million, based on the consensus of five market researchers, up from a 15.8 million pace a year earlier.

While incentive spending on discounts has risen, auto manufacturers have kept that in check by showing restraint on production. So car buyers aren’t being offered the blowout deals they once enjoyed when sales softened.

“Automakers aren’t under as much pressure to move the metal at any cost,” said Jessica Caldwell, head of insights for Edmunds. “No one has started an incentives war in which other automakers feel obliged to join in to protect their market share. .”

Get insights into Upcoming Cars In India, Electric Vehicles, Upcoming Bikes in India and cutting-edge technology transforming the automotive landscape.

First Published Date: 02 Oct 2024, 06:46 AM IST

Leave a Reply