Volkswagen AG and labor leaders are moving closer to an agreement to restructure the brand without shuttering factories in Germany, according to peop

,

Volkswagen AG and labor leaders are moving closer to an agreement to restructure the brand without shuttering factories in Germany, according to people familiar with the matter.

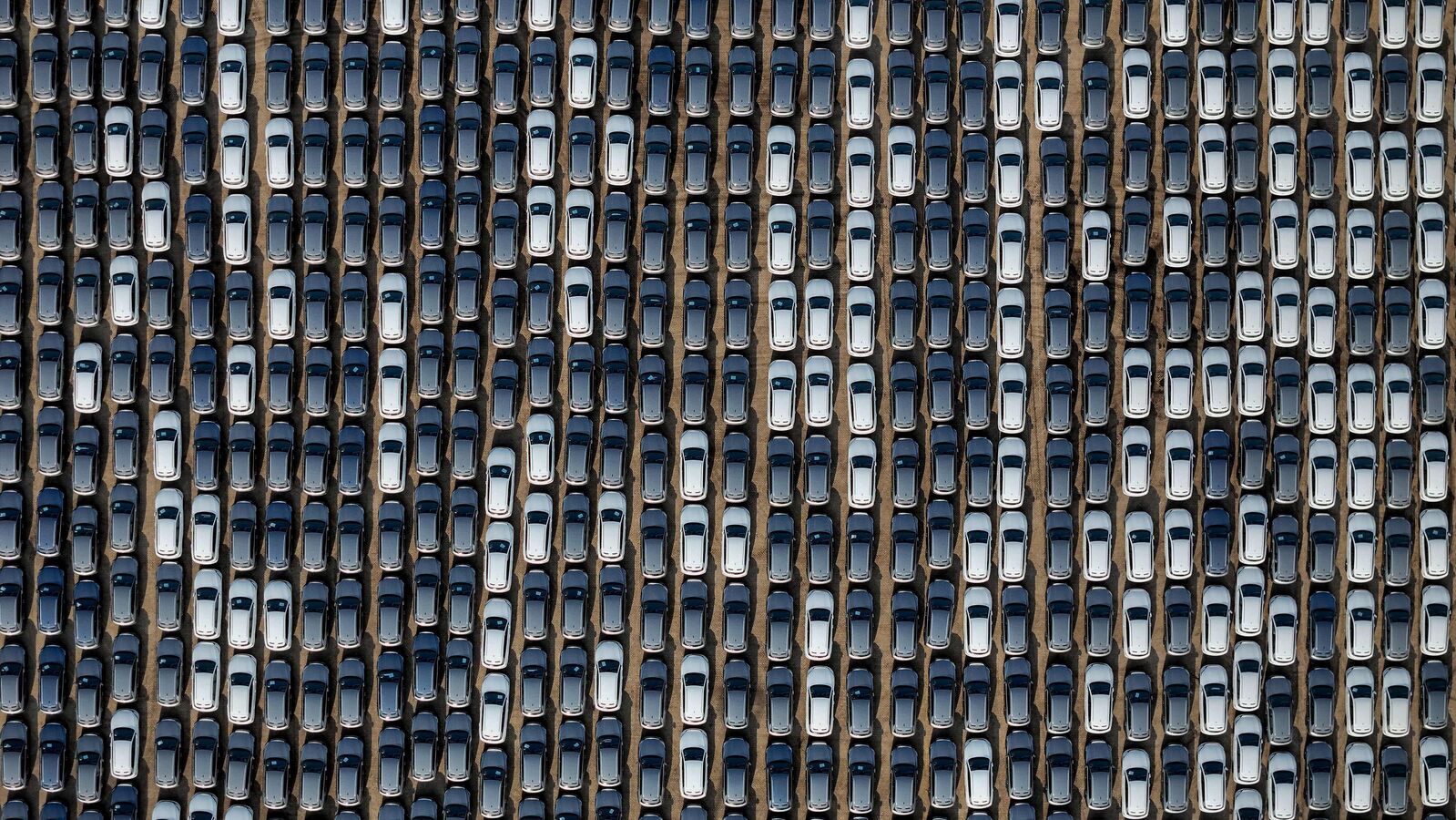

Volkswagen AG and labor leaders are moving closer to an agreement to restructure the automaker’s namesake brand without shuttering factories in Germany, according to people familiar with the matter. Management is willing to keep plants running and reinstate job security agreements until 2030 in return for workers foregoing bonus payments, said the people, who asked not to be named because the discussions are private.

Additional cost-cutting measures discussed include moving production of the Golf hatchback from Germany’s Wolfsburg factory to Mexico, and ending production of VW-branded electric vehicles in Zwickau to trim capacity, the people said.

New Labor Agreement To Reinstate Job Security Until 2030

An agreement would prevent widespread walkouts and hand Chief Executive Officer Oliver Blume the fresh start he’s seeking to turn around Europe’s biggest carmaker. VW is trying to reduce costs and excess capacity across its German production network as it confronts dwindling market share in China and slowing demand for electric vehicles in Europe and the US.

The details of a deal could change and the talks, which are expected to continue into Friday, may still end without an agreement, the people said. Both sides have been holding a fifth round of negotiations since Monday. Spokespeople for Volkswagen and IG Metall declined to comment.

The latest proposals are a far cry from the drastic savings measures VW floated previously. Management proposed laying off workers, cutting wages and closing three German factories to help save €17 billion ($17.6 billion) at the VW brand that’s struggling with inefficiencies in Europe and rising competition in China.

Employees foregoing bonus payments and VW reshuffling production won’t be sufficient to save an additional €4 billion annually, which management needs to bolster margins, UBS analyst Patrick Hummel said Thursday. “We’re not sure this is really the final package,” he told Bloomberg Television.

Under the deal being hammered out, the production of VW’s ID.3 hatchback and ID.4 SUV would end in Zwickau and shift to Wolfsburg and Emden, the people said. Zwickau also risks losing the Cupra Born hatchback to Wolfsburg, leaving the site in eastern Germany with just Audi models and chassis production.

To compensate for the loss of capacity, Zwickau is being considered for a car recycling project that would require as many as 1,000 jobs, the people said. Wolfsburg is poised to make VW’s electric Golf that will be underpinned by a new platform developed with Rivian Automotive Inc. and expected to be ready in 2028.

VW’s corporate structure gives workers a strong voice in key decisions, making it difficult for management to unilaterally push through painful cost cuts. Employee representatives occupy half of the company’s supervisory board seats, while VW’s home state of Lower Saxony holds an additional two seats.

Previous conflicts with unions ended or shortened the tenures of top executives including former CEO Bernd Pischetsrieder, ex-VW brand chief Wolfgang Bernhard and Herbert Diess, Blume’s predecessor as CEO. All three tried to push through efficiencies, particularly at VW’s domestic German operations.

Any cuts at VW, still one of the biggest employers in Germany, will ripple through Europe’s largest economy, which is set to shrink for a second straight year due to dwindling exports and high energy prices following Russia’s invasion of Ukraine. Political campaigning in the country kicked off on Monday after Chancellor Olaf Scholz lost a confidence motion in the lower house of parliament, triggering a new federal election that will likely take place on Feb. 23, seven months ahead of schedule.

VW shares declined 0.4% in Frankfurt. They’re down 22% this year.

Automakers are battling a sales slowdown in Europe, where consumers under pressure from elevated living costs are balking at the high price of EVs. New-car registrations in the region declined 2% in November from a year earlier to 1.06 million units, led by sharp falls in France and Italy, the European Automobile Manufacturers’ Association said Thursday.

Volkswagen’s peer Stellantis NV is trying to recover from a disastrous year that culminated in the ousting of former Chief Executive Officer Carlos Tavares. Manufacturers are separately facing billions of euros in fines if they fail to meet stricter European fleet emissions rules slated to kick in next year.

Suppliers have also announced drastic cost-saving measures in response to the slump in demand. Robert Bosch GmbH, ZF Friedrichshafen AG and Schaeffler AG are among the parts makers that are pursuing thousands of job cuts as the fallout hits the industry’s supply chain.

The VW talks are dragging on in part because of their complexity. Negotiations center not just on wages across the VW brand but also on model planning across VW’s factory network and the company’s five-year investment planning process.

Check out Upcoming Cars in India 2024, Best SUVs in India.

First Published Date: 20 Dec 2024, 18:39 PM IST

Leave a Reply