- GST Council has increased the tax rate for used old electric vehicles sold by businesses from 12 per cent to 18 per cent.

The Goods and Services Tax Council, headed by Union Finance Minister Nirmala Sitharaman and comprising representatives of all states and UTs, decided to increase the tax rate on used old electric vehicles by 18 per cent on Saturday. However, the revised tax rate for electric vehicles will not affect individual sellers but the businesses selling the used electric vehicles clarified the GST Council. The tax hike is steep, as before this increase, the used electric vehicles were taxed at a rate of 12 per cent.

Also Read: Upcoming cars in India

Union Finance Minister Nirmala Sitharaman, after the 55th GST Council meeting, said the panel decided to raise the rate of tax to 18 per cent from 12 per cent on all used EV sales, just as in the case of non-electric vehicles. She also stated that this new tax rate will be applicable only to the value that represents the margin, which is the difference between the purchase price and the selling price. However, despite this tax rate hike, the sale and purchase of used electric vehicles by individuals will continue to be exempted from GST.

How new GST rate on EVs impact you

To date, old and used vehicles, including electric vehicles, were subject to be taxed at a rate of 12 per cent, except for petrol engine-propelled vehicles with an engine capacity of 1200 cc or bigger and a length of 4,000 mm or more, diesel vehicles with an engine capacity of 1,500 cc or bigger and a length of 4,000 mm or more, and SUVs, which attract 18 per cent GST.

With this price hike, the dealers selling the used and old electric vehicles will sell the EVs with 18 per cent GST, which will be included in the retail pricing for the consumers, which means the buyers purchasing pre-owned electric vehicles from the dealerships, but not from individual sellers, will have to pay six per cent more compared to what they had to pay before the latest price hike.

New GST rate may impact EV growth in India

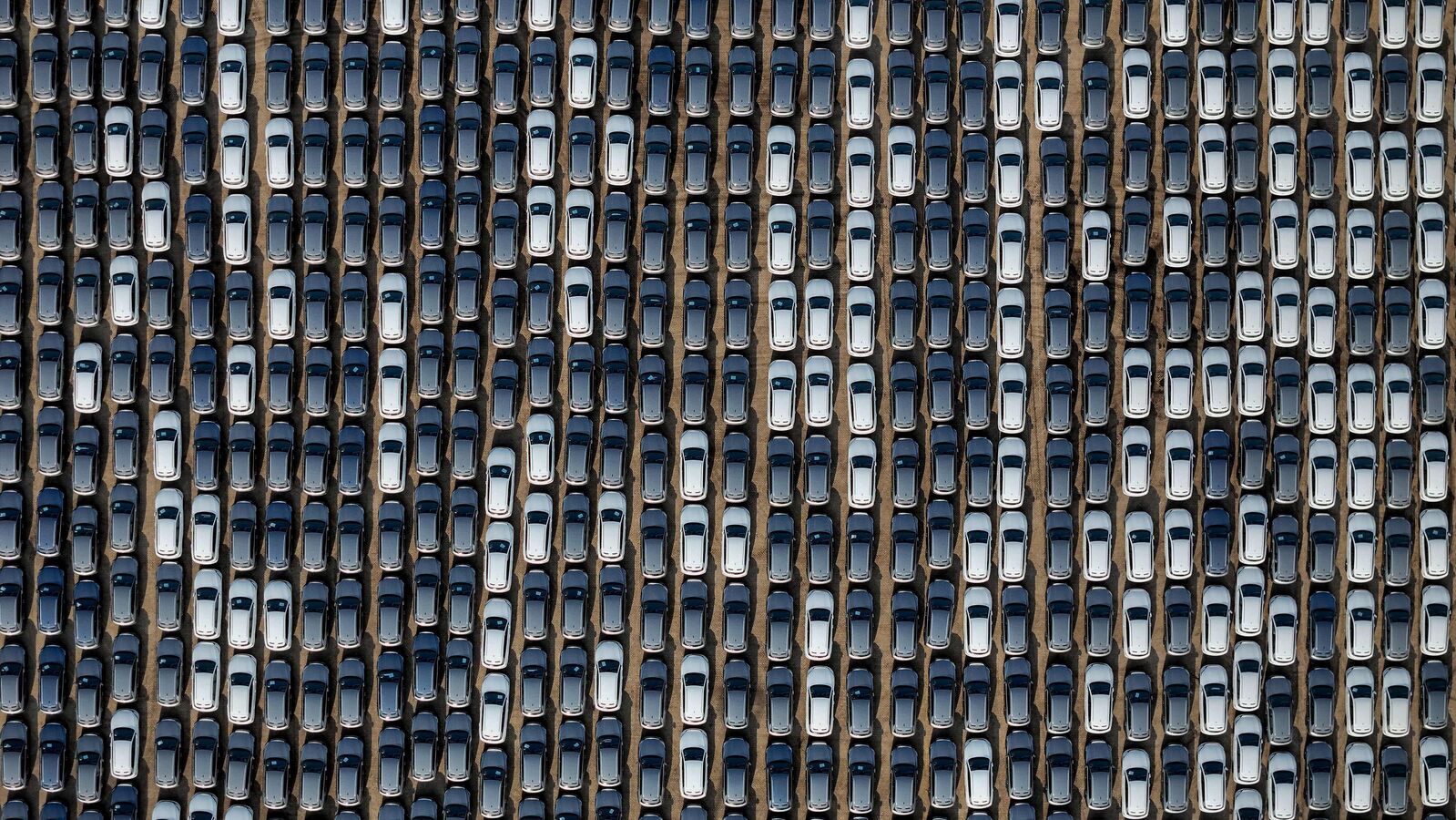

The electric vehicle industry in India is witnessing a rapid growth. The EV industry in India is majorly driven by the sales of new vehicles. However, with the rising number of EVs in the market, the industry is witnessing a growth in pre-owned electric vehicle sales as well, which are driven by both individual sellers and dealerships. With this GST rate hike move, the dealerships will be impacted hard, which will eventually affect the consumers who seek to buy used electric vehicles.

Get insights into Upcoming Cars In India, Electric Vehicles, Upcoming Bikes in India and cutting-edge technology transforming the automotive landscape.

First Published Date: 22 Dec 2024, 08:48 AM IST

Leave a Reply