The Group of Ministers (GoM) on GST compensation cess is likely to get a six-month extension till June 2025, to submit their report.

The Group of Ministers (GoM) on GST compensation cess is likely to get a six-month extension till June 2025, to submit their report. The goods and services tax council Saturday decided to keep gift vouchers, offered by several sectors such as retailers, out of tax purview, a uniform tax rate of 18% on used cars including electric vehicles purchased by businesses, while deferring a decision on reduction in Tax rate on insurance products.

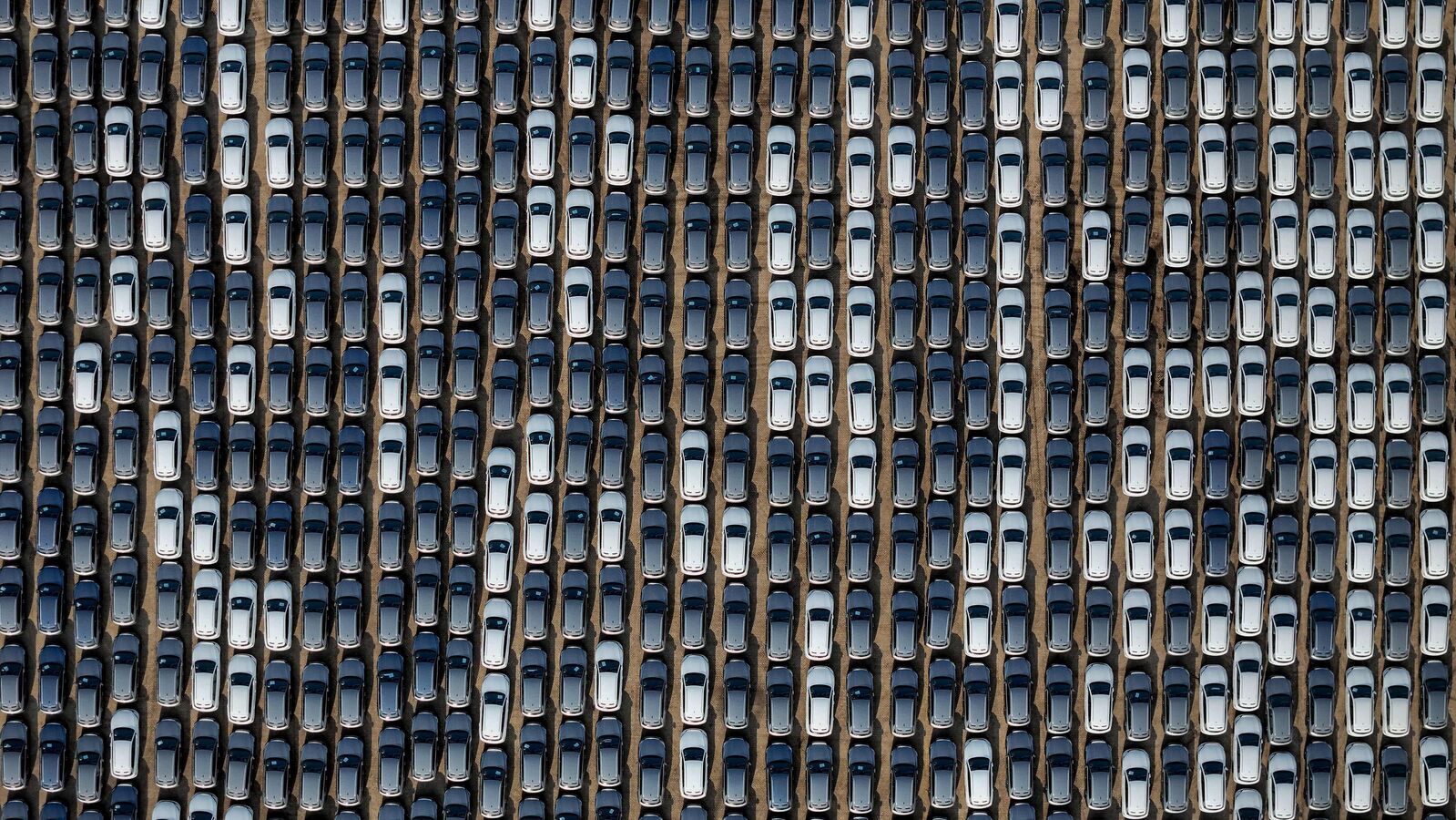

The change in rate of tax in the case of EVs will not impact individual sellers.

The council, chaired by union finance minister Nirmala Sitharaman, decided to reduce the tax rate on fortified rice kernels to 5% from 18%.

It agreed to clarify that ready to eat popcorn, which is pre-packaged and labeled mixed with salt and spices, to face 12% and caramelised popcorn a rate of 18%, continuing with the existing regime.

A decision on reducing the rate of tax on insurance was deferred as there was still a lack of consensus within the group of ministers looking into the tax structure for the sector. The matter has now been referred to the fitment panel for further examination.

The GoM had recommended exempting insurance premiums paid for term life insurance policies from GST and premium paid by senior citizens for health insurance cover. It had also suggested GST exemption on premium paid by individuals, other than senior citizens, for health insurance with coverage of up to INR 5 lakh.

The report of the GoM on rate rationalization, which had recommended tweaks in 148 items, was not tabled before the Council. Bihar deputy chief minister Samrat Chaudhary said it could be tabled at the next meeting.

Clarification on tax on used car sales

The council decided to raise the rate of tax to 18% from 12 % for all vehicles including EV’s which will be applicable only on the value that represents margin of the supplier, that is, the difference between the purchase price and selling price (depreciated value if depreciation is claimed).

At present, all old and used vehicles including EVs (other than petrol vehicles of engine capacity of 1200 cc or more and of length of 4000 mm or more, diesel vehicles of engine capacity of 1500 cc or more and of length of 4000 mm and SUVs ) attract 12% GST. Old and used petrol vehicles of engine capacity of 1200 cc or more and of length of 4000 mm or more, diesel vehicles of engine capacity of 1500 cc or more and of length of 4000 mm and SUVs attract 18%. The council has now approved making this rate uniform at 18% for all vehicles, including EVs.

The Group of Ministers (GoM) on GST compensation cess is likely to get a six-month extension till June 2025, to submit their report. The compensation cess regime comes to an end in March 2026, and the GST Council has set up a panel of ministers, under Union Minister of State for Finance Pankaj Chaudhary, to decide the future course of the cess.

Leave a Reply